Monday, February 8, 2010

Investment in UBS by GIC – a Chronicle of a Disaster in the Making

It was mid-December 2007 [A] when the Government of Singapore Investment Corp. (GIC) made a whooping 11 billion Swiss francs (S$13.8 billion) investment in UBS.

There was news earlier in the summer of 2007 about how the US housing market was showing signs of slowing down, but some of the major financial institutions were still raking in record profits and numerous equity indices were nearing their all-time highs.

UBS was amongst the first of the banks to show signs of cracking. A day before GIC announced its investment, the bank had just announced a write-down of US$10billion[1] and the money raised was necessary to maintain its capital ratio and ease market fears of its stability.

As GIC became the largest single shareholder of the Swiss giant (circa 9%), deputy chairman and executive director Dr Tony Tan said in a statement that GIC had “confidence in the long-term growth potential of UBS’s business, particularly in the global wealth management business”.[2]

The word “long-term” does not have a fixed definition, but in the world of finance and markets, anything longer than five years is generally considered “long-term”.

With UBS it never rains – it pours

Since that fateful day for GIC, UBS’s fortunes had gone from bad to worse.

Throughout 2008, rival banks began to report massive losses, but very few had worse results than UBS. The Board reacted by changing the management team and the new management team introduced cuts across the board, from staff numbers to bonuses.

All the cuts had very little impact and in April 2008 [B], the bank’s ratings were downgraded by major rating agencies. This essentially increased the bank’s borrowing costs in the open market and further damaged its reputation of being a stable Swiss bank. The losses were mainly from its investment banking and trading arm, but alarmed customers in its wealth management division were leaving the bank.

In October, the bank had little choice but to turn to the Swiss central bank for assistance. [C] In an unprecedented move, the usually non-interventional Swiss Central Bank technically bailed out UBS via an agreement to ‘ring-fence’ US$60billion of UBS’s illiquid (and poor quality) assets.[3]

By then it was clearer to the markets – UBS has dabbled in the US sub-prime mortgage markets more actively than any other of their European rivals and was hurting from it.

For the entire 2008 financial year, the bank lost a total US$17billion, the largest loss in Swiss corporate history. Only Citibank, Wachovia, Merrill Lynch and Bank of America had lost more in this crisis.[4]

An Imminent Collapse?

While the losses were staggering, it still can be said that with the backing of the Swiss government, UBS remains stable financially, at least in the short term.

However, the viability of the bank’s business model in the long run was thrown into uncertainty in Feb 2009.[D]

It was announced that that the bank had been made liable to pay a $780million to the taxman in the United States to settle an investigation into its operations.[5] They had also initially agreed to divulge the identities of some of their clients who had used the bank to park their wealth offshore to evade taxes in the US.

Since the Middles Ages, Swiss banks had leveraged on their reputation to protect identities of their clients to lure wealthy customers, who are willing pay huge fees to the bank. UBS, in particular, was a massive player in the murky world of private wealth management. By helping rich Americans set up offshore accounts right under the noses of the taxman, the bank had approximately earned over $200million annually.

At time of writing, the case between the US tax authorities and UBS is still ongoing. The American government wants the bank to reveal all of the clients they had ever helped to evade tax, but UBS is negotiating to only disclose some of these Americans and not all. This high profile case had involved the governments from both countries and is now turning into a diplomatic issue.

This is a classic case of a catch-22 for UBS. On one hand, if they do back down and hand in the details of their clients to the US government, they will lose more customers in its wealth management business. They can no longer charge higher fees than their rivals because they no longer have that competitive edge over them. In business terms, the bank’s critical success factor will be lost. The bank may almost have to restart its wealth management business from scratch, in a market already saturated with other banks.

On the other, if UBS decides not to co-operate, the US Courts may revoke their banking licence in the country all together. No statistics and figures are required to show how a global bank like UBS will suffer if they are not allowed to trade and operate in the world’s largest economy.

Last week, Swiss Justice Minster warned that UBS may fail if no agreement was reached.[E][6] The headlines may be sensational, but he may not be exaggerating. If UBS does not suggessfully negotiate past this hurdle in the short-term, there will be no “long-term” future to talk about and Dr Tony Tan’s words will haunt GIC forever.

GIC has no management involvement in UBS, so will not be directly implicated in this court case. However, if UBS does fail, the entire S$13.8bn invested will likely go down the drain (less any amounts recovered upon liquidation).

S$13.8bn. That is nearly S$3,000 for every man, woman and child from Tuas to Changi in the island of Singapore.

Singapore Property

Overview

Singapore is an island state with a limited amount of undeveloped land. As the population continues to grow, mainly due to foreign influx, the trend is to build higher buildings to optimise the use of land.

Most Singaporeans (over 80%) live in apartments built and managed by Housing and Development Board (HDB). The rest of the Singaporeans own and live in private apartments/condominiums or live in a landed property.

Foreigners moving into Singapore typically rent in one of the private apartments/condominiums (varying from older/basic ones to luxurious ones with wide variety of facilities) or large landed houses. Expatriates form the majority of the private rental market. However, most landlords are Singaporeans and investing in real estate is very common among wealthier Singaporeans.

The government recently increased the allowed floor space that can be built per square foot of land ('plot ratio'). This combined with increasing overseas demand for private apartments has resulted into a trend of developers buying up older (typically 20+ years old) private apartment blocks via 'en-bloc sales'. These are then redeveloped into modern, taller and often much more luxurious developments.

Property Types

Residential properties in Singapore can be divided into three main categories: Private apartments, landed properties and HDB apartments. If you are a foreigner, you need to understand the difference as there are ownership restrictions on the latter two.

Private apartments are classified either as apartments or condominiums by the government. The distinction is somewhat artificial, but typically apartments are smaller developments and condominiums generally have more facilities and are larger. Most condominiums come with swimming pool, tennis court, gym, squash court, children playground and a BBQ area. They also typically have their own enclosed car park and security guards looking after the security at the entrances and the whole area around the condominiums. Tenure of private apartments is commonly freehold, 99-year leasehold or 999-year leasehold.

Landed property classifications are, for example, terraced house, semi-detached house, detached house, good class bungalow and shop house. The main point to note is that they are tied to the land title. Landed properties are typically freeholds, but there are 99 and 999-year leaseholds in the market as well. As land is scarce in Singapore, you can expect landed properties with large plots to be very expensive - especially near the city centre.

HDB apartments are flats built and maintained by Housing and Development Board, with the government subsidising the purchase and financing of these. HDB estates with a concentration of a number of HDB apartment blocks are designed to be self-contained neighbourhoods - with coffee shops, supermarkets, food centres, clinics, schools, library, shopping malls, playgrounds and parks. HDB estates are also well served by public transportation system (buses and MRT). HDB apartments are always 99-year leaseholds and typically lack the facilities of private apartments.

Executive Condominiums are somewhere between HDB apartments and private condominiums. There were created for professional young people who want better than HDB, but cannot afford private condominiums. They are government subsidised and can only be bought if a certain criteria is met - similar to HDB criteria. They will automatically convert into no restrictions private properties after 10 years from construction. They cannot be sold at all during the first 5 years, and they cannot be sold to a foreigner during the first 10 years from construction.

Restrictions for Foreigners

Foreigners can rent private apartments and landed properties, as long as they have a valid long-term permit to stay in Singapore. It is illegal for landlords to provide accommodation for illegal immigrants, so a proof of valid stay is required when renting an apartment - typically an employment or student pass. However, renting out a whole HDB apartment is subject to approval from HDB and the tenant is advised to check that the landlord has the permission.

As in many other countries, Singapore has restrictions on foreign ownership of property. The Singapore government has recently relaxed the restrictions in order to attract foreign investment as well as foreign talent as part of a drive to increase Singapore's population and economy - although few people expect the restrictions on land ownership to be lifted any time soon. There are currently no restrictions for foreigners to buy private apartments. However, foreigners cannot buy landed properties without specific case-by-case approval from the government. And even then there are restrictions on the use of the property e.g. most cannot be rented out unless in a mixed commercial and residential area.

Foreigners holding Singapore 'Permanent Residency' or 'Citizenship' status can also buy HDB apartments directly from the government or through the re-sale market. To qualify for the HDB scheme:

-

Applicant must either be a Singapore citizen or PR with at least one other sibling who is a PR.

-

Applicants must be at least 21 years old.

-

Applicants must form a family nucleus - either married or intending to get married; or with parents, siblings and/or children.

-

(Optional) The combined income of all persons in the application must not exceed S$8,000 a month in order to qualify for CPF Housing Grant.

HDB has other schemes for special cases – please check http://www.hdb.gov.sg/ for details.

Expatriate Living

- regions in Singapore

- budget and property prices

- property type – house vs. apartment

- transportation

- international schools

Introduction

When moving to Singapore for the first time, an Expatriate would normally rent an apartment or a landed house. Expatriates are generally concentrated in certain areas that have a wide variety of condominiums to choose from. Typically you would consider the following factors when looking for a property for the first time in Singapore:

-

Budget for rental

-

Type and size of property you want to live in

-

Distance to work and transportation links

-

Proximity to international schools, if you have any children of school going age.

-

Restaurants and entertainment and other free time options in the neighbourhood

-

Distance to the Airport, if you or your partner plan to travel a lot

Let's have a look at the regions in Singapore first and then tackle the main factors in detail.

Regions in Singapore

Singapore is approximately 50km wide and 30km long, and the city centre is located in the central southern part of the island. The main office area that is in the city centre is also referred as Central Business District (CBD), and the main shopping area is around Orchard road, as well in the city centre. As most of the entertainment options are also concentrated in the central area, it is not surprising that the most popular areas for expatriates to live in are in and around the city centre - but there are other attractive options as well. Singapore is divided into 27 districts starting at '1' in the central area as shown below

Map of Singapore Island

District Map of Singapore

Central Area (Districts 01 – 09, 11)

Central areas offer some of the most luxurious and expensive living in Singapore. Tanglin area and the road towards Holland Village at the end of Orchard Road is probably the most prestigious - and most embassies are located around here as well. Newton (north of Orchard) and River Valley (south of Orchard) are more popular among single professionals and young couples. The Singapore river area (Robertson Quay, Clarke Quay & Boat Quay) has especially been rejuvenated in the recent years and boasts now numerous restaurants and bars. On the other hand, there are few condominiums in the CBD and the activity can be somewhat quiet during the evenings as it is mostly offices. Central areas offer very short distances to most free time attractions and are also well served by public transportation to and from to various parts of the island.

Holland Village and Bukit Timah (Districts 10, 21, also parts of District 05)

Bukit Timah area has many landed properties, but there are also some condominiums to choose from. It would be a good choice if you want a landed property and/or live in a quieter neighbourhood. It also has many good schools and is popular among families. Many well-off Singaporeans also live in this area. Holland Village is popular hang-out place among expatriates living in the area and it has quite a few restaurants and bars, as well as some shopping amenities for daily needs. Bukit Timah Nature Reserve and water reservoir areas are also nearby. They are the biggest green spaces in Singapore and are very popular for outdoor activities.

East Coast (Districts 14, 15, 16)

The road from CBD towards Changi Airport, know as East Coast, has numerous Condominiums to choose from - some with a very nice sea view. The condominiums tend to be more expensive closer to the city centre (known as Tanjong Rhu area). Apart from the attraction of living close to the sea, there is also East Coast Park that stretches along the coast and gives numerous free time options for the outdoor types. Parkway Parade offers some large scale shopping in the middle of East Coast.

The biggest downside in the east coast is probably the distance to the MRT line. The Eastern MRT line does not go along the coastline, and you would have to take a bus to the MRT station, or just use a taxi, if you do not opt for own car. However, a new Circle Line due to be completed by 2010 will add 4 new stops to the West side of the East Coast area.

Other Areas

It is not to say that there are no other options for expatriates. There are condominiums and private housing on offer all around the island and you may also get more for your money than in the most popular areas. Notably Woodlands is popular among American Expatriates, because of the American school and the spacious housing offered there - preference among them being for landed properties.

Budget and Property Prices

The rental prices fluctuate heavily depending on the supply and demand of the available units. The rental prices for private properties have in many places doubled in the last two years, as also happened during the 90's property boom. The following table gives you a rough idea what you can expect with what kind of budget currently:

| Location | Property Type | Rental Range |

|---|---|---|

| Central (Newton, Holland Village, River Valley, Orchard, Tanglin) | 1-bedroom apartment | S$3,000 – S$7,000 |

| 2-bedroom apartment | S$3,500 – S$8,000 | |

| 3-bedroom apartment | S$4,500 – S$10,000 | |

| Penthouse / 4+ bedrooms | S$6,000 – S$20,000 | |

| Terraced House | S$6,000 – S$25,000 | |

| Bungalow | S$15,000 – S$60,000 | |

| East Coast & Bukit Timah | 1-bedroom apartment | S$2,500 – S$4,000 |

| 2-bedroom apartment | S$3,000 - S$5,000 | |

| 3-bedroom apartment | S$3,500 - S$7,000 | |

| Penthouse / 4+ bedrooms | S$5,000 - S$15,000 | |

| Terraced House | S$7,000 – S$10,000 | |

| Bungalow | S$12,000 – S$40,000 | |

| Other Areas | 1-bedroom apartment | S$2,000 – S$3,000 |

| 2-bedroom apartment | S$2,500 – S$4,000 | |

| 3-bedroom apartment | S$2,800 – S$5,000 | |

| Penthouse / 4+ bedrooms | S$3,200 – S$8,000 | |

| Terraced House | S$5,000 – S$10,000 | |

| Bungalow | S$8,000 – S$20,000 |

Property Type – House vs. Apartment

Expats typically live in either an apartment/condominium or a landed house. This is a matter of preference and budget. Typical condominiums in Singapore have multitude of facilities - e.g. swimming pool, gym, tennis courts, children playground, and BBQ pits. And they are usually within a walled compound with security guards around, although Singapore is not a dangerous place at all. Because the plot sizes are relatively small in Singapore, only the very luxurious landed properties have pools and other facilities. For somebody moving from a colder climate, you have to also remember that Singapore is in the tropics and there are more small animals (insects, geckos) around than you may be used to. These tend to cause more problems in landed properties, especially close to green areas. But if you have the budget, there are some very nice bungalows to live in that will give you the luxury and privacy that a condominium would not be able to do.

Transportation

Singapore has one of the most modern and best functioning transportation systems in the world, and travelling from any point in the island to another does not take very long in normal conditions. Car ownership can be expensive in Singapore, but on the other hand the roads are good and less congested than in many other cities of similar population density. Public transportation is also very good, but tends to be more concentrated in areas where the Singaporeans live (close to HDB estates). In any case, unless you really live at the edge of Singapore, your commuting time would rarely exceed one hour.

Your main options for moving around are described below

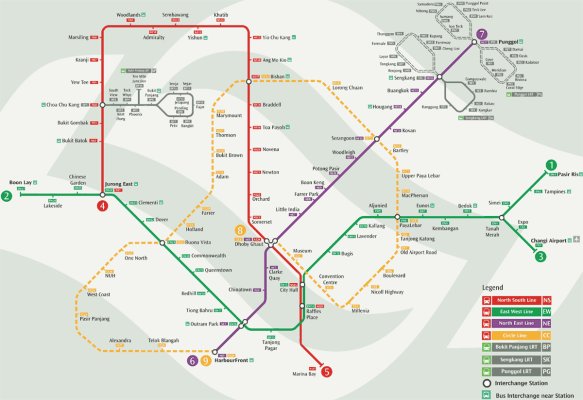

Mass Rapid Transport (MRT)

MRT, Singapore’s metro/underground system, currently has 3 lines (4th being built currently). Our map search shows the location of MRT stations in Singapore. We will also give you details of the distance to the closest MRT station for each listing.

Map of Singapore’s MRT links

Bus

Singapore also has extensive bus network that covers much larger area than MRT. You can find bus routes here. It's not possible to show the entire bus map on a single map however you can find details at http://sbs.streetdirectory.com.sg/sbs/sbsindexsn.jsp?map=1

Taxis

Taxis are generally plentiful and cheap compared to many other countries. This would probably be the transport of choice for most single professionals living close to the city centre. Sometimes it can be difficult to get one during peak hours, and extra charges apply for calling one and during peak hours.

Private Cars

Owning a private car is expensive relative to many other countries and is not really necessary in Singapore. Most people would save money by using taxi rather than owning a car. However, owning a car gives you freedom to move around - and popping to Malaysia every now and then to have a round of golf might be a big enough reason to get one.

Traffic conditions are generally good in Singapore. But be aware of all the charges that you have to pay when owning a car:

-

Purchase price – Cars are probably one of the most expensive in the world to buy in Singapore due to import duties and Certificate of Entitlement (COE – a permission to own a car for 10 years, after which it has to be renewed).

-

Road tax – depending on the size of the engine, you need to pay road tax every year. This can vary from a few hundred for a small car to thousands for an SUV.

-

Electronic Road Pricing (ERP) – during peak hours you have to pay fees (S$0.50 to a few dollars) to enter through certain roads and areas (mostly in central area). ERP locations can be found at www.lta.gov.sg/motoring_matters/motoring_erp_location_cbd.htm

-

Parking – parking may or may not be offered for free at your office. Especially, in CBD it can be quite expensive. Also, typically you would have to pay for parking in most locations when out in town. Condominiums usually have parking included in the maintenance fee (which is paid by the landlord).

-

Petrol – it may come as a surprise, but petrol is probably the smallest component of you car ownership costs. It is currently around S$1.80 / litre.

You will also need to convert your driver's license into Singaporean once within a year. This is relatively straightforward process, but will require you to sit the basic theory test. The road traffic in Singapore is on the left side of the road (as in UK and Malaysia).

International Schools in Singapore

There are many international schools in Singapore to cater for the needs of expatriates. For most large groups of expatriates, you have a choice of sending your children to a school which follow your national curriculum and teaching is in your native language. These are the main international schools in Singapore – please check their websites for more information.

Australian International School

1 Lorong Chuan, Singapore 556818

Bhavan's Indian International School

11 Mt Sophia Blk E, Singapore 228461

Canadian International School

5 Toh Tuck Road, Singapore 596679

Chatsworth International School

37 Emerald Hill Road, Singapore 229313

http://www.chatsworth-international.com/

Dover Court Preparatory School

301 Dover Road, Singapore 139644

DPS International School

36 Aroozoo Avenue, Singapore 539842

EtonHouse International School

51 Broadrick Road, Singapore 439501

German School

72 Bukit Tinggi Road, Singapore 289760

Hollandse School

65 Bukit Tinggi Road, Singapore 289757

http://www.hollandseschool.org/

International Community School

514 Kampong Bahru, Singapore 099450

ISS International School

21 Preston Road, Singapore 109355

Japanese Kindergarten

251 West Coast Road, Singapore 127390

Japanese School (Primary)

95 Clementi Road, Singapore 129782 (Clementi Campus)

11 Upper Changi Road North, Singapore 507657 (Changi Campus)

Japanese School (Secondary)

201 West Coast Road, Singapore 127383

KGS International Pre-School (Japanese)

16 Ramsgate Road, Singapore 437462

http://pachome1.pacific.net.sg/~yoko/kinder/kgs.html

Lock Road Kindergarten

10 Lock Road, Singapore 108938

Lycee Francais De Singapour

3000 Ang Mo Kio Ave 3, Singapore 569928

http://www.lyceefrancais.edu.sg/

Norwegian Supplementary School

c/o Royal Norwegian Embassy, 16 Raffles Quay #44-01 Hong Leong Bldg, S048581Tel:

Overseas Family School

25F Paterson Road, Singapore 238515

Rosemount Kindergarten

25 Ettrick Terrace, Singapore 458588

Rosemount International School

461 Telok Blangah Road, Singapore 109022

Sekolah Indonesia

20A Siglap Road, Singapore 455859

Singapore American School

40 Woodlands Street 41, Singapore 738547

Singapore Korean School

74 Lim Ah Woo Road, Singapore 438134

http://www.koreansingapore.org/

Swedish Supplementary Education School

c/o Swedish Embassy, 111 Somerset Road #05-01 Singapore Power Building,

Singapore 238164

Swiss School

38 Swiss Club Road, Singapore 288140

http://www.swiss-school.edu.sg/

Tanglin Trust School

95 Portsdown Road, Singapore 139299

United World College of South East Asia

1207 Dover Road, Singapore 139654

Waseda Shibuya Senior High School

57 West Coast Road, Singapore 127366

http://www.waseda-shibuya.edu.sg/

We have provided some other useful websites for schooling matters:

-

Directory of Local Schools - www1.moe.edu.sg/schdiv/

-

Studying in Public Schools - www.croxxing.com/english/info_overview.html

-

Fee Structure Public Schools - www.croxxing.com/english/info_fees.html

-

Ministry of Education - www.moe.edu.sg/

-

Foreign Student Information - www.moe.gov.sg/esp/foreign/ and www.moe.gov.sg/csc/csc_admission.htm#Foreign

-

Foreign Student Admission Application Form - www.moe.gov.sg/esp/foreign/FSApplForm.pdf

-

CQT Application Form - www.moe.gov.sg/esp/foreign/CQTForm.pdf

-

Advice for Expatriates to Place Children in Local Schools - www.moe.gov.sg/esp/eduinfo/

-

School Terms and Holidays - www.moe.edu.sg/schapp/frames3.htm

.jpg)